Head and shoulders candlestick pattern:

If used correctly, the Head and Shoulders Candlestick Pattern is one of the most popular and reliable chart patterns you can trade.

The best and simplest way to trade the stock market or the forex market is by using chart patterns. In this video, we will discuss the head and shoulders pattern, its formation, extra tips that are never discussed, and finally how to trade it profitably.

Any time frame can be used to trade the head and shoulders candlestick pattern. In the video we cover a few tips to help you adjust according to the timeframe you choose to trade off with, or find this pattern on.

This is the first of a series of videos in which we will go through every chart pattern that Steve Nison studied and published in his book “Beyond Candlesticks“. Each pattern will be discussed individually. Please test it out once you have learned it so that you can use it in your trading and increase your win rate and profitability.

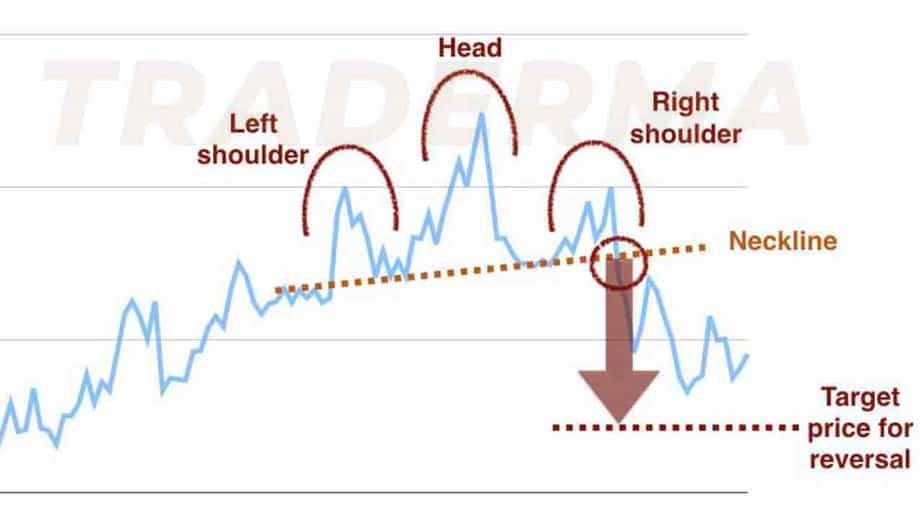

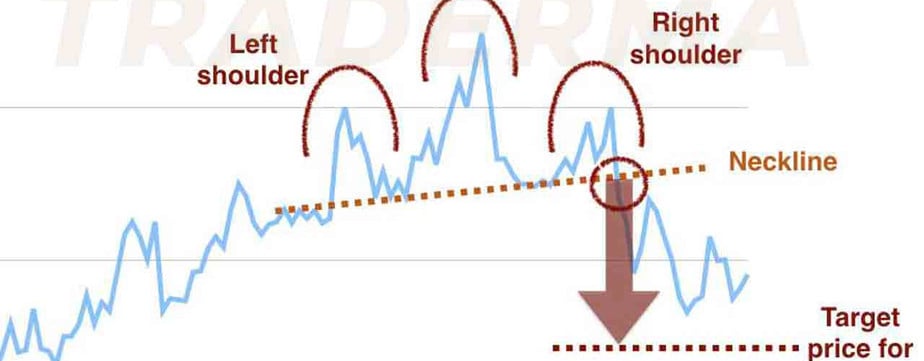

Head and shoulders candlestick pattern consists of several candlesticks that form a peak, Head and shoulders candlestick pattern makes up the head, and two lower peaks that make up the left and right shoulders. The right shoulder on these patterns typically is lower than the left but many of times it’s may equal. Sometimes there’s a fake out which makes right shoulder higher than the left.

Explanation

The head and shoulders candlestick pattern consists of several candlesticks forming a peak, the head, and two lower peaks that make up the shoulders. Most often, the right shoulder on these patterns is lower than the left, but it may also be equal. It’s not uncommon for the right shoulder to be higher than the left when there is a fake out.

Take a position only when you know your profit goal and risk limit.

– Antoroy

Head and shoulders pattern in technical analysis:

In technical analysis, a head and shoulders candlestick pattern is a chart formation with three peaks. The outer two peaks are closely spaced and the middle one is the highest. In technical analysis, a head and shoulders pattern describes a specific chart formation that indicates a trend reversal from bullish to bearish.

Intraday trading strategies: Best indicators for day trading forex

Intraday trading strategies, tips and tricks, and discover how our expert traders use technical analysis chart patterns.

Intraday trading success has proven to be a time-tested formula based on the fundamental analysis and understanding of trends.

Day trading or intraday trading consists of short-term trades lasting less than a day. It can even last for a few seconds or minutes.

Timeframe for day trading:

Traders pick between the higher timeframes of 1 hour and the lower timeframes of 1 hour when choosing their timeframe.

Understanding the differences between multiple time frames and individual timeframes for day trading is very important so you can pick the one that works best for your personality type and complements your strengths.

Multiple time frame trading strategy forex: Intraday Trading strategies

The multiple time frame trading strategy forex will be one of the most important variables all intraday traders will need to consider. The intraday trading time frame directly determines which intraday trading strategies and best indicators for day trading forex are most effective for intraday traders. While intraday traders often hold their positions for long periods in a row, day traders usually hold their positions for a short period of time.

Choosing the right time frame for your trading is not an easy task.

A forex trader who uses multiple time frames faces a wide variety of options when starting their career in trading

Introducing one. When you are a position trader, use higher time frames such as a weekly chart.

Secondly, for swing traders, use intermediate time frames, such as a 4-hour chart.

Three. An intra-day trader should use lower time frames, such as a 15-minute chart.

“How to get rich even if you have no clue about technology with Bitcoin”

A globe-trotting vagabond’s surprising wealth-building method

Add comment